Introduction

In times of high inflation rates, high fiscal deficits in most major countries and growing skepticism about governments’ capacity to repay their debt, a theory that links inflation to fiscal imbalances seems particularly timely. Cochrane (2023) provides such a link in his formulation of the Fiscal Theory of the Price Level (FTPL).

The FTPL is a theory where inflation is driven by fiscal policy. In a nutshell, an increase in government debt via bond issuance can lead to inflation because the price level is determined by the government’s balance sheet identity, dubbed by Cochrane (2023) “government valuation equation”. According to this equation the real value of government debt must be equal to the present value of expected future real budget surpluses. Whenever an imbalance arises, the price level adjusts to restore equilibrium.

If, for example, the government increases bond issuance and people do not expect higher taxes in the future to pay off the new debt, the real value of the bonds decreases via higher inflation until balance is restored in the valuation equation. Money creation, or even money itself, is of secondary importance for the FTPL in explaining inflation.

Cochrane (2023) puts together three decades of scattered contributions to the FTPL in one place. The present paper discusses the basic aspects of the FTPL and assesses its relevance for understanding inflation. It argues that the FTPL’s “Chartalist” foundations makes it difficult to incorporate inflationary dynamics that are not rooted in government action. In particular, the loss of purchasing power resulting from money creation through credit extension to the private sector is difficult to capture.

In addition, since the government valuation equation is based not on the actual but on the expected budget, application of the FTPL without considering the circumstances may lead to false diagnoses. If, for example, credit extension by commercial banks to private entities is the cause for higher inflation, the FTPL may falsely interpret this as a change in people’s expectations of future budget surpluses to repay debt – a claim that is hard to falsify as these expectations cannot be observed. Nevertheless, the FTPL is an important addition to explanations of inflation which may become highly relevant in the near future.

Why do people hold money?

Cochrane’s (2023) starting point of the Fiscal Theory of the Price Level (FTPL) is that people value money because the government accepts it for tax payments. Money, so Cochrane, is a useful medium of exchange as a result (Cochrane 2023, p. 3)[1]. This view echoes the state theory of money, or “Chartalism” (Knapp 1921). In a Chartalist view of the money system, the state can create money through legal acts without backing it with commodities such as gold or silver. By declaring paper money as legal tender and accepting it for tax payments, the government creates “public money” (White, 2023, p. 8).

The public money, however, must meet people’s needs for the Chartalist theory to hold. Otherwise, people will seek alternatives. In today’s Venezuela, for example, despite the government only accepting rapidly devaluating Bolivares for tax payments, people prefer to use US dollars, Bitcoins and even gold flakes as a means of payment and store of value (White 2023, p. 6). As people hold money for other reasons than paying taxes, Chartalism, and therefore the FTPL, have limits in its application.2

Nevertheless, even if people hold money balances for different subjective reasons, the government's acceptance of tax payments in a specific currency can still increase its value to users. This point was made by Adam Smith (1776) when he condemned local governments in the North American colonies for inducing people to use government issued notes that were payable at a future date and bore no interest, by only accepting such notes for tax payments.3 The notes were given “some additional value” by declaring them as legal tender.

Cochrane refers to Adam Smith’s critique to support the Chartalist premise: “A prince, who should enact that a certain proportion of his taxes be paid in a paper money of a certain kind, might thereby give a certain value to this paper money.” (Smith, Adam, 1776, Book II, Chapter II, p. 418). The context of the passage, however, makes clear that Smith was not in favour of a Chartalist constitution of money. Rather, he criticized the use of state power to force people to use paper notes as money, which “might thereby give a certain value” to them. Yes, declaration of legal tender might give money some value, but does not decisively determine the value of paper money. For Adam Smith money emerged from people’s need to barter, without the need of state intervention.

What backs money?

Behind the Chartalist premise of the FTPL lies the notion that fiat money is backed by future budget surpluses of the government. For Cochrane (2023, p. 284) the FTPL is “at heart a backing theory. Money is valued as a claim to something real”. The numeraire in today’s monetary system, so Cochrane, is short-term government debt, i.e. the fiat currency which the debt securities promise at maturity,4 and the “something real” backing the debt is the future flow of budget surpluses (p.7)5. Future budget surpluses, however, are unknown. They depend on the government’s future taxing abilities and willingness to repay.

The backing of a currency, however, goes beyond the government itself, even for state-issued currencies. “In the end, a means of exchange is backed by the trust of users that they can exchange it against things they want” (Mayer 2018, p.85). Therefore, the backing of the public fiat money is not only the trust in the government being able and willing to repay its debt. In Somalia, for example, the government-issued Shilling was still in circulation even after the government collapsed in 1991 and could not collect taxes anymore. People had no reason to stop accepting a currency which their trade partners were also accepting in exchange for the goods and services they wanted just because there were no abstract potential future budget surpluses backing the currency (White 2023, p. 127). In Japan during the 1800s, instead of using newly government-issued currency, people stuck to the old “unbacked” one because they better met their needs for exchanging goods (D’Amico 2023).

The trust in being able to exchange money against goods and services can certainly be undermined by a government’s mismanagement. At the same time, a government’s abuse of its currency motivates people to look for alternatives. It might take a large amount of abuse for people to lose trust in established fiat currencies such as the US-Dollar or the euro given their wide use, but it is not impossible. As a store of value, they have already lost a lot of ground. Cochrane explores alternatives to short-term government debt as numeraire such as private currencies and cryptocurrencies. For him, however, these are basically technical, not monetary innovations, and promise therefore little new insights.

All in all, a Chartalist interpretation seems applicable to our current monetary system, but it falls short of providing a complete explanation for why people value money. The current monetary institutional framework in advanced economies has converged towards state currencies as a medium of exchange. Even when they do not fulfill all expectations, the established state currencies are useful for people’s needs and therefore valued. As a storage of value, people may prefer real assets, such as real estate, or commodities, such as gold, both unrelated to a government, but at the same time they may find it useful to use state currencies as a means for transactions.

Assuming that people only use state currencies because they have to use them to pay taxes seems too big a stretch in light of monetary history and reality. People’s subjective motives for using and holding currency go further. Thus, the FTPL can provide a framework for analysis as long as state currencies play the dominant role. But Cochrane’s (2023) basic assumption that people’s motives to hold a certain currency depends on this currency’s need for tax payments alone seems too strong.

Moreover, the FTPL only considers liabilities of the central bank as money and, therefore, glosses over bank-issued credit money. Mayer (2018, p. 66) describes the creation of money in the current monetary system as a public-private partnership between the government and commercial banks. The government regulates the banks, provides deposit insurance, and the central bank manages the money creation process. Banks issue credit money or the so-called “inside money” by creating deposits when they extend credit. Central banks issue notes and bank reserves, the so-called “outside money”, in response to commercial banks’ credit money creation. The FTPL, however, focuses on “outside money” and neglects that, in the fiat credit money system, outside money is derived from inside money, i.e., credit money.6

Thus, ignoring money created through bank lending leaves the FTPL to a large degree blind to inflation in a monetary system in which credit plays a key role for investment, economic growth, and prices (Mayer 2018, p. 39). The FTPL will not be able to see an inflationary impulse coming from money creation through credit expansion to the private sector - more on this below.7

How the FTPL explains inflation

At the core of the FTPL as described by Cochrane, lies the “government valuation equation” (Cochrane, 2023, p. 21):

where Bt denotes the nominal stock of money and government bonds in time t, Pt+1

is the price level of the economy in t+1, Et+1

is the rational expectations operator for time t+1,βj

is the time discount rate and st

is the government surplus in time t (Cochrane, 2023, p.30).

The equation represents one version of the balance sheet identity of government finances. In general, the real value of its liabilities (left hand side) must equal the real value of its assets (right hand side). Liabilities consist of the bonds issued by the government in addition to money created by the central and commercial banks through credit extension.8 Assets can be measured as fixed real capital and financial claims, as is customary in company balance sheets, or as the present value of real net income expected in the future. In the equation above, the latter is defined as real surpluses of the government budget.

Cochrane (2023) takes the primary surplus instead of the total budget surplus. Hence, the present value of the expected real primary surpluses must be large enough to cover the present values of both cumulated future interest payments and the stock of the outstanding debt. With the present value of primary surpluses defined in real terms, the discount rate to calculate this value must also be real. It can be derived from market interest rates by adjusting for expected inflation.

According to the FTPL, the price level changes when the valuation equation is violated in the sense that the real value of the government liabilities is ex ante not equal to the expected present value of the real primary surpluses. An imbalance in the government’s balance sheet identity can result from changes on the left- or on the right-hand-side of the equation. If the money supply increases (left-hand side) along with the expected future real budget surpluses (right-hand side), changes in the price level will not be needed to restore balance sheet identity. But if, for instance, the real value of debt is ex ante higher than the expected value of the real future budget surpluses, the price level increases until the real value of the liabilities is again identical to the real value of assets ex post.

The concrete mechanisms for price adjustments in the FTPL are first, as emphasized by Cochrane, asset pricing intuition. Whatever the cause, an imbalance means that government liabilities are not fully backed by future budget surpluses. Without the necessary “backing”, people want to exchange their holdings of government liabilities (bonds and money) for goods and services. The sale of claims on the government raises aggregate demand for goods and services and – ceteris paribus - the price level.

The second mechanism is a wealth effect. If people sell bonds to buy other assets, which are increasing in value due to the higher aggregate demand for those assets, people’s wealth increases, raising their consumption of goods and services (Cochrane 2023, p. 27). Leeper et al. (2011) offer a slightly different interpretation of the wealth effect based on the absence of Ricardian Equivalence (and rational expectations) in household behavior. Households perceive the additional debt securities sold to them by the government as an increase in their personal wealth and thus spend more as they do not expect higher future tax liabilities.

The idea that people behave in accordance with Ricardian Equivalence is empirically only weakly supported. To bolster his assumption of rational expectations, Cochrane (2023, p.25) argues that changes in expectations about the scale of bond issuance during government debt rollovers influence spending decisions and, consequently, inflation.9

Public Sector Balance Sheets

An alternative to the “government valuation equation” – which Cochrane (2023) does not explicitly consider – would be public sector balance sheets along the lines of private sector balance sheets. Government assets would consist of financial claims and fixed capital instead of the present value of expected future budget surpluses. Theoretically, the two concepts should be identical as properly valued assets should be equal to the present discounted value of their future returns.

Calculating the value of the assets of the public sector is no easy feat. However, the International Monetary Fund has done this for 55 countries. These estimates are more tangible than the airy concept of the present discounted value of expected future government budget surpluses. But Cochrane (2023) and others do not use these data.10

FTPL and other inflation theories

It is possible, so Cochrane, to use the valuation equation to fit the prevailing monetarist and output-gap inflation theories. From a monetarist perspective inflation is the result of “too much money chasing too few goods.” Assuming a constant velocity of money, inflation results from an increase in the supply of money above demand. Translated into the language of the FTPL, an increase in money supply is an increase of total government liabilities Bt. Inflation is the result of the adjustment of the price level to the new increased supply of government liabilities when expected budget surpluses do not increase with the money supply.

From the perspective of the output gap theory, inflation is the result of “overheating”, with the economy running above potential. Translated into the language of the FTPL, revenue reductions or increases in debt financed government spending would reduce the right-hand side and increase the left-hand side of the valuation equation, provoking a rebalancing through inflation.

A key characteristic of the FTPL’s explanation of inflation is that the right-hand-side of the government valuation equation refers to expectations. But the expected present value of the real government surpluses is an unobservable variable in the equation and can easily change. A tweet, a single announcement of the finance ministry or a change in the credit rating can move expectations, triggering an inflationary rebalancing.

Reducing the explanation of inflation to changes in expectations makes the theory hard to apply in practice. Any change in the price level can always be explained by a change in expectations, which can be observed empirically only through polls or inferred from financial market data. With biases possible in these data, the FTPL needs therefore to be used with caution.

The FTPL seems compatible with the theory of financial repression. According to the latter, overindebted governments force the central bank to depress nominal interest rates below nominal GDP growth. As a result, the ratio of government debt to GDP declines on trend when the primary government budget is balanced. This would be consistent with the combination of a passive monetary policy and an active fiscal policy aimed at restoring government solvency described below but is not developed in Cochrane (2023).

Bank money and credit cycles

As mentioned above, the FTPL only considers government liabilities as money. In our current monetary system, however, money is created by banks as they extend credit. Money creation through credit to the private sector cannot cause inflation in the FTPL because it does not interfere with the government valuation equation. However, credit can be a major source of inflation and business cycles. This is a key blind spot of the FTPL in our view.

Mayer (2018) explains how inflation through credit money creation works based on the insights from the Austrian school of economics. In a nutshell, money creation in a fiat monetary system causes a credit boom, successive changes of relative prices through the economy and ultimately a loss of purchasing power. In the current public-private-partnership, as explained above, money is created through credit extension by commercial banks. Since additional money holdings allow people to either consume or save more than before, the consequences of money creation will be different depending on the need for funds of whoever receives the newly created money.

Those with a lack of funds for purchasing consumption goods and services will tend to spend more on such goods and services. Those whose needs for consumption funds are already satisfied will use the new money to purchase assets to restore the desired money-to-asset relation in their portfolios. The additional demand for the specific goods, services or assets starts a chain of increasing prices in varying magnitudes and changes in relative prices which end up reducing the purchasing power of money (Mayer 2024, p.7). Such a dynamic can unfold without changes in government budget surpluses and remains therefore unexplained by the FTPL.

The definition of the “price level” is a further blind-spot of the FTPL. The FTPL, as well as the Keynesian and monetarist theories of inflation, “implicitly assume that money descends on the economy like a warm rain, where it either first incites economic activity until the price level rises or somehow raises the price level directly” (Mayer 2018, p. 34). In the real world, however, an inflationary impulse starts somewhere in the economy and transmits through the economy price increases as well as changes in relative prices on its way. If the inflationary impulse starts in asset prices, all three (Keynesian, monetarist and FTPL) inflation theories would not capture it – as illustrated by the asset price boom after the Great Financial Crisis of 2008-09.

According to FTPL a reduction of the expected value of future budget surpluses would motivate bondholders to sell. The effects of the sell-off will depend on the preferences of the sellers and investment alternatives available to them. Bond holders could, for instance, buy sovereign bonds from other countries, corporate bonds or real assets. Increasing asset prices might motivate people to buy even more assets, as available collateral for credit rises. At this point it is unclear whether people would start buying consumption goods and services such as food, toilet paper, running shoes, flight tickets, meals in restaurants, or haircuts. Even with inflation expectations increasing, people might rather buy something that holds value over time. As long as people don’t “feel richer”, the FTPL would not capture the price adjustments taking place in the economy.

FTPL, ZIRP and QE

We believe that the developments after the Great Financial Crisis of 2007/2008 illustrate the gaps in the FTPL. In 2009 the Fed Funds Rate was (almost) zero, and the Federal Reserve had already started buying financial securities against newly created central bank money. The European Central Bank (ECB) followed six years later. The consumer price indices continued to increase at stable rates below the inflation targets of 2% in both regions.

The FTPL’s explanation would have been that neither the zero interest rate policies (ZIRP) nor the asset purchases (QE) of the central banks affected the government valuation equation. The ZIRP made the increase of government debt affordable as interest rates fell below the GDP growth rate - thanks to the “forward guidance” of the central banks with little uncertainty about the future. As a result, the expected present value of government surpluses remained stable. In other words, people expected government debt to "eventually be repaid” without an increase in taxes (Cochrane 2023, p. 462).

In the logic of the FTPL, Quantitative Easing did not modify government liabilities as expected budget surpluses remained unchanged and the price level well behaved. But the money stock increased by large amounts. Governments issued new bonds, which central banks swapped into money through their government bond buying programs. In the view of Cochrane (2023, p. 227), low interest rates and the announcement of central banks that QE would be temporary, kept the government valuation equation intact and consumer prices well-behaved, nevertheless. But whether the credibility of fiscal policy was really responsible for the failure of consumer price inflation to rise in response to ZIRP and QE cannot be checked against expectations of future government budget surpluses for lack of data.

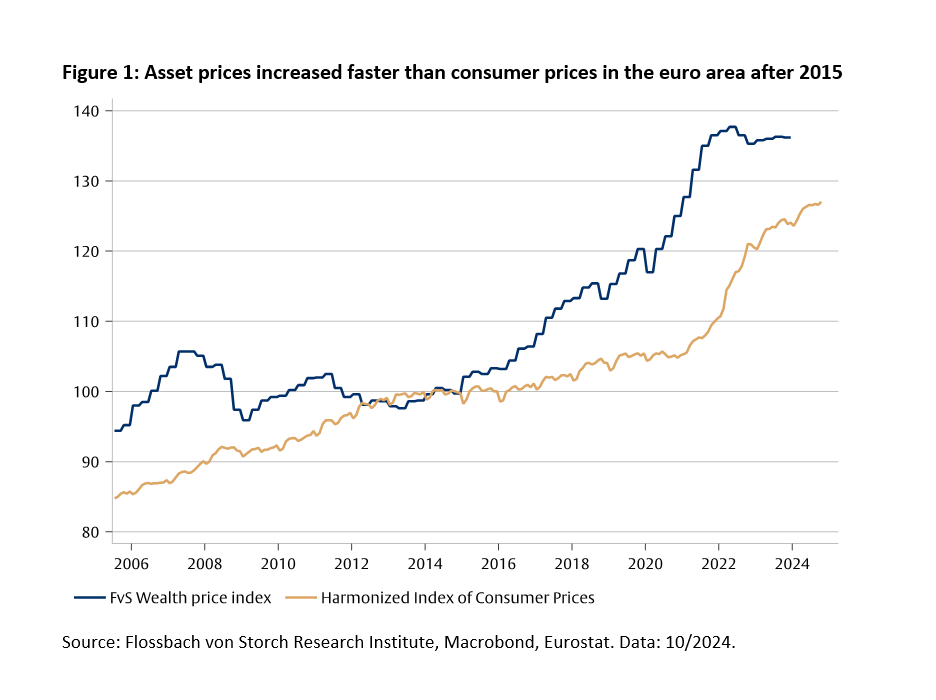

Against this, the developments in asset prices can be interpreted as an indication that money creation through credit extension played a key role. With the start of the asset purchasing program of the ECB in 2015, financial and real asset prices as measured by the FvS-Wealth price index for the Eurozone increased much faster than the harmonized consumer price index. Additional government liabilities were obviously swapped by investors into other assets as they adjusted their portfolios to the excess supply of government debt. Since investors tend to be wealthier than the public in general, they obviously had little need to spend proceeds from bond sales on consumer goods so that consumer prices were little affected. This changed during the Pandemic, when governments transferred fresh money created by bond sales to the central banks to the public. Now, people used it to adjust actual to desired consumption and inflation surged.

The inflation created during the Pandemic could be explained with the FTPL as resulting from a loss of trust in governments’ ability to create budget surpluses in the future to fund the increase in present debt. The fact that interest rates rose to, or above, real GDP growth could have played a role in the loss of trust. But such foresight of the public does not seem very credible. More likely is that people simply spent the “helicopter money” they got to fulfill desired consumption, which was impossible during the pandemic lockdowns or before the Pandemic due to a shortage of funds.

Active and passive fiscal and monetary policies

Even if inflation always has a fiscal component in the FTPL, monetary policy nonetheless plays an important role. Monetary policy will be less or more successful in controlling inflation depending on the institutional setting of a country and the resulting fiscal policy stance.

According to the FTPL, inflation expectations depend on the current interest rate and therefore can be guided with an interest rate target (Cochrane 2023, p. 32) when the public holds rational expectations (Cochrane 2023, p. 38). Thus, inflation surprises can only happen if there are surprises in the expectations of future budget surpluses. The result is that monetary policy manages “expected” inflation through targets for inflation and interest rates, while fiscal policy is responsible for unexpected inflation.11

The FTPL distinguishes between active and passive states of fiscal and monetary policy. A passive fiscal policy adjusts revenue and expenditure to maintain the government valuation equation (Cochrane 2023, p. 17). An active fiscal policy prioritizes other goals over holding up the government valuation equation. Monetary policy is active when it targets inflation and passive when it pursues other goals, such as government solvency or full employment.

According to the FTPL, the monetarist idea that inflation is always a monetary phenomenon can only be true when fiscal policy is “passive” and monetary policy “active”. With passive fiscal policy, the government keeps the valuation equation even if unpopular measures such as tax increases or expenditure cuts are necessary. In this setting, an independent central bank following an inflation target could keep inflation low without inflation surprises induced by fiscal policy (Leeper 1991).

With active fiscal policy, however, monetary policy no longer controls inflation. Changes in the price level ensure that the government valuation equation holds, and monetary policy becomes passive. The central bank needs to generate seigniorage revenue by printing money to keep the government solvent (Sargent and Wallace, 1981).

The interest rate policy puzzle

The mainstream views on inflation take it for granted that central banks can control inflation by changing interest rates. In the FTPL, however, interest rate hikes (cuts) increase (decrease) inflation. The intuition within the model is straightforward. As higher interest rates increase the government’s refinancing costs, debtors see a decrease in the government’s ability to repay its debt as higher interest payments reduce expected future budget surpluses. The public will therefore sell bonds and money holdings to buy goods (or assets and then goods). Inflation increases until the valuation equation is restored.

Cochrane himself struggles with this prediction of the model.12 If the model were correct, Turkey’s attempts to combat inflation by cutting policy rates in the last years would have been successful. The conventionally assumed effect of interest rate increases on inflation can only be produced in the model under certain conditions such as sticky prices, unexpected interest rate changes and large amounts of long-term domestic-currency debt outstanding. Even in that case, interest rate increases can just cause a temporary decline in inflation at the cost of higher inflation in the future.

The counter-intuitive result comes from the initial assumption of rational expectations of households. Perfectly informed and knowledgeable households of course see the extent to which increasing policy rates will affect future surpluses and act accordingly. But this seems like a big stretch.

Conclusions

All in all, Cochrane (2023) offers a thorough and valuable explanation of the Fiscal Theory of the Price Level. He explains its building blocks and uses it to explain inflation history through the lens of fiscal theory. He also explores monetary institutions, monetary policy in the framework of the FTPL, and deals with the main differences with the established Keynesian and Monetarist theories.

For him “the fiscal theory is a genuinely new theory that unseats its predecessors at the foundation of monetary economics” (Cochrane 2023, p. xii). However, as explained above, this seems an overstatement to us. From the point of view of practitioners, FTPL is a “situational” theory like the other inflation theories – which also claim universal validity. It is very useful in certain circumstances but fails in others (Mayer 2024).

Looking ahead, the FTPL has significant potential to explain a possible resurgence of inflation. The Great Financial Crisis and the Coronavirus Pandemic have left governments with debt-to-GDP ratios unprecedented during peacetime. Additionally, with China and Russia, supported by North Korea and Iran, increasingly opposing the West, the time of peace is ending, giving way to a period of wars —both cold and hot. Government debt is therefore likely to rise further.

The time may come when investors lose confidence in government solvency and begin selling government bonds and fiat credit money. This will drive up the price level as determined by the government valuation equation. As inflation accelerates and monetary policy —dominated by fiscal policy — becomes passive, even the general public may lose faith and dump fiat credit money in exchange for goods, services, and inflation hedges.

Historical experience suggests that wartime levels of government debt will eventually be reduced through runaway inflation. Where political stability prevails, governments will regain control over inflation after it has done its job reducing the real value of public debt. Where political regimes change, new governments, in a break with the past, are likely to turn to currency reforms, imposing losses on the holders of the old currency.

____________________________

1 “As one simple story, the fiscal theory of the price level answers: Money is valued because the government accepts money for tax payments. If on April 15 you have to come up with these specific pieces of paper, or these specific bits in a computer, and no others, then you will work hard through the year to get them. You will sell things to others in return for these pieces of paper. If you have more of these pieces of paper than you need, others will give you valuable things in return. Money gains value in exchange because it is valuable on tax day. Money gains value in exchange because it is valuable on tax day” (Cochrane, 2023, p. 3).

2 As John Cochrane puts it (in his comments to this paper): “It is a theory adapted to current large country institutions: fait money, no money supply control, interest rate targets.”

3 “The paper of each colony being received in the payment of the provincial taxes, for the full value for which it had been issued, it necessarily derived from this use some additional value, over and above what it would have had, from the real or supposed distance of the term of its final discharge and redemption”. (Smith 1776, Book II, Chapter II, p. 418).

4 “We have converged on a monetary system in which short-term nominal government debt is the numeraire, unit of account, and by and large medium of exchange” (p. 302).

5 “We may view the fiscal theory as a backing theory of money. Dollars are valuable because they are backed by the government’s fiscal surpluses. Many financial liabilities are valuable because they are a claim to some assets. Many currencies have been explicitly backed by assets such as gold. Dollars say ‘This note is legal tender for all debts, public and private,’ so you have the right to pay your taxes with dollars. That right constitutes a backing. Dollars backed by gold can be soaked up by giving people the gold in return for dollars. Our dollars can be soaked up by taxes.” (p. 7).

6 The terms “inside” and “outside” money come from the time of fractional reserve banking, when banks created credit money from a fixed stock of base money. But today banks create credit money without a “base” and demand reserves from the central bank to facilitate deposit transfers. Hence, “inside” drives “outside” money, contrary to what the terms seem to suggest.

7 According to John Cochrane, FTPL can include inside money as an instrument for liquidity, and excess liquidity may induce inflation. But there seems to be no room for the credit channel in inflation generation.

8 Since the central bank is a government bureaucracy, its liabilities are also the government’s. Monetary liabilities of commercial banks are indirect liabilities of the government as the state guarantees (legally and factually) the exchange of bank money at parity into central bank money. Thus, from the Chartalist perspective, all money is state money and hence a government liability.

9 “Yes, the indirect cause of inflation can be a worry about surpluses in the far future. But the direct mechanism is a loss of faith that debt will be rolled over.” (p. 26).

10 In his comments, John Cochrane explains this with data quality. In his view, it is easier to measure public sector flows than stocks. On the other hand, it may be even harder to measure expected flows than existing stock.

11 “Monetary policy," choosing interest rates {it} without changing fiscal policy, can fully control expected inflation in this simple model. Fiscal policy fills in the gap, determining unexpected inflation and thus fully determining inflation.” (p. 34).

12 “You can see by the length of this discussion—indeed, of this book—that I struggle with the clear predictions of the theory developed so far. They are simple and logically transparent, but they are quite different from conventional doctrine and its stylized narrative of history and policy choices: Higher interest rates eventually produce higher inflation. There is a limited mechanism for a short-run negative sign, but it only works for surprises, with long-term debt outstanding, and it produces an instant disinflation that melts away, rather than a slowly increasing disinflation. Moreover, it operates via a wealth effect, not via higher real interest rates that depress aggregate demand.” (P. 161, revised Chapter 5 from 1/4/2023).

_____________________________________________________________________________

References

Cochrane, J. H. (2023). The fiscal theory of the price level. Princeton University Press.

D'Amico, John. "The making of paper money in early modern Japan." The Economic History Review (2023).

Knapp, G. F. (1921). Staatliche Theorie des Geldes. Duncker & Humblot.

Leeper, E. M. (1991). Equilibria under ‘active’ and ‘passive’ monetary and fiscal policies. Journal of Monetary Economics, 27(1), 129-147.

Leeper, E. M., Walker, T. B., Sims, C., & Bordo, M. D. (2011). Perceptions and misperceptions of fiscal inflation (Vol. 364). Bank for International Settlements, Monetary and Economic Department.

Mayer, T. (2018). Austrian economics, money and finance. Routledge.

Mayer, T. (2024). A Latticework of Inflation Models. The Economists’ Voice, Vol. 21, No. 1 (and 240410-a-latticework-of-inflation-models.pdf)

Sargent, T. J., & Wallace, N. (1981). Some unpleasant monetarist arithmetic. Federal reserve bank of Minneapolis Quarterly Review, 5(3), 1-17.

Smith, A., (1776). The wealth of nations. Bantam Books.

White, L. H. (2023). Better Money: Gold, Fiat, Or Bitcoin?. Cambridge University Press.

LEGAL NOTICE

One of the purposes of this publication is to serve as advertising material.

The information contained and opinions expressed in this publication reflect the views of Flossbach von Storch at the time of publication and are subject to change without prior notice. Forward-looking statements reflect the judgement and future expectations of Flossbach von Storch. Actual performance and results may, however, differ materially from such expectations. All information has been compiled with care. However, no guarantee is given as to the accuracy and completeness of information and no liability is accepted. The value of any investment can fall as well as rise and you may not get back the amount you invested

This publication does not constitute an offer to sell, purchase or subscribe to securities or other assets. The information and estimates contained herein do not constitute investment, legal and/or tax advice or any other form of recommendation. In particular, this information is not a replacement for suitable investor and product-related advice and, if required, advice from legal and/or tax advisers.

This publication is subject to copyright, trademark and intellectual property rights. The reproduction, distribution, making available for retrieval, or making available online (transfer to other websites) of the publication in whole or in part, in modified or unmodified form is only permitted with the prior written consent of Flossbach von Storch.

Past performance is not a reliable indicator of future performance.

© 2025 Flossbach von Storch. Alle Rechte vorbehalten.