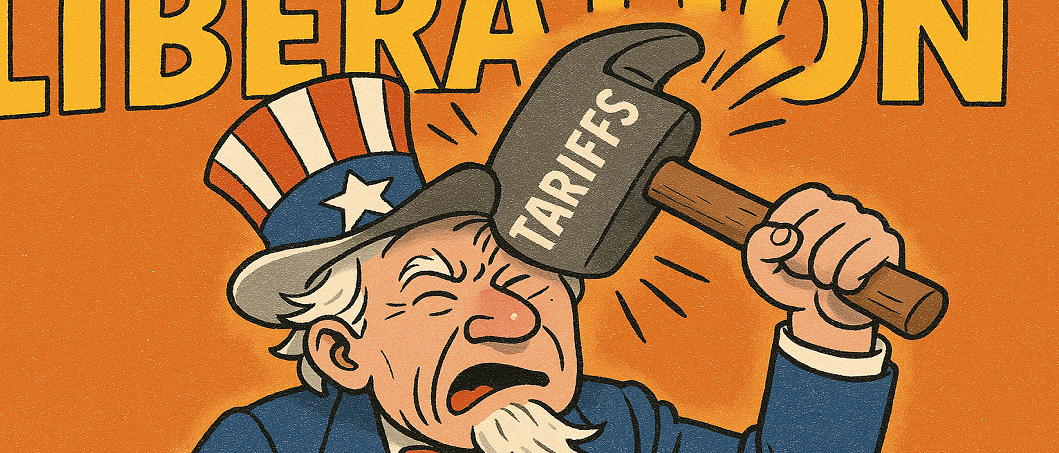

The tariff shock goes around the world

Despite many inconsistencies in Donald Trump’s politics over the last decades, one thing on his agenda remains unchanged: his belief that tariffs can cure the U.S. trade deficits and boost the U.S. economy.

Surrounded by a like-minded crowd in the Rose Garden at the White House on his “Liberation Day” of April 2, 2025, President Trump announced new tariffs on a wide range of nations – friends and adversaries alike. He also introduced so-called reciprocal tariffs to match the duties that trading partners impose on U.S. exports. The underlying motivation is to end the “unfair trade practices” of foreign countries that brought “hard working American citizens (…) to sit on the sidelines as other nations got rich and powerful, much of it at our expense”. With the announced tariffs, President Trump once again promised “to make America great again – greater than ever before.”1

The announced tariffs are shocking in several ways. By imposing a minimum rate of 10% on all imports, the U.S. is bringing the average tariff rate to its highest level since the mid-1930s (Fig. 1). They also exceeded expectations regarding individual reciprocal tariff rates.2

Table 1 summarizes the core information from the announcement of April 2, 2025. It shows the U.S. bilateral trade deficit with its main trading partners, the tariff rate each country allegedly imposes on American goods and the discounted reciprocal tariffs the U.S. now intends to apply. Countries with which the U.S. does not run a trade deficit, such as the UK, Australia, Brazil and Singapore (not listed in the table), will still be charged with a baseline 10% tariff.

Methodology behind reciprocal tariffs

According to the Office of the U.S. Trade Representative (the Office thereafter), the tariffs currently charged to the U.S. – upon accounting for currency manipulation and trade barriers – “are calculated as the tariff rate necessary to balance bilateral trade deficits between the U.S. and each of our trading partners.”3 The core assumptions of the calculation are that:

- “persistent trade deficits are due to a combination of tariff and non-tariff factors that prevent trade from balancing”,

- “[t]ariffs work through direct reductions of imports“,

- “offsetting exchange rate and general equilibrium effects are small enough to be ignored”.4

The reasoning of the Office is simple enough to be sketched on a beer mat. A tariff increase reduces imports by an amount equal to , where Δτi is the change in the tariff rate on country i, ε is the elasticity of imports with respect to import prices and φ is the passthrough from tariffs to import prices. The bilateral trade balance with country i (TBi) after applying the tariff is therefore equal to U.S. exports to country i (xi) minus U.S. imports from country i (mi) corrected by the tariff-induced reduction of imports. In other words:

. (1)

Accordingly, the change in tariff rate that would bring the trade balance to zero is:

. (2)

Based on – albeit extremely selective – evidence from the academic literature, the Office assumes ε=4 and φ=0.25, which simplifies the change in tariff rate to:

. (3)

This equation means that the change in the tariff rate that would be necessary to bring the trade balance to zero can be obtained by dividing the bilateral trade balance of the U.S. with country i by U.S. imports from country i. The Office uses equation (3) to calculate the tariffs that trading partners allegedly impose on U.S. goods (Table 1).

Instead, Figure 2 shows the implied tariff rate changes on U.S. imports from its trading partners over time. Disregarding the variability over time, the Office based the calculation of the implied tariff on trade data from 2024. To “rebalance” their bilateral trade deficits, Vietnam and China would require exceptionally high tariffs – 90.4% and 67.3% – while Canada and Mexico would need much lower rates, at 15.3% and 34%. The EU and Japan fall somewhere in between, with implied rates of 38.9% and 46.2%. Since the actually imposed reciprocal tariffs are only half of the implied rates, trade deficits could only be reduced by 50%.

Figure 3 shows that the implied tariff rate change with respect to the UK, Australia, Brazil and Singapore has been negative for the last decade: the U.S. runs a trade surplus with these countries. Without providing much economic reasoning, the Executive Order of April 2, 2025 announcing the reciprocal tariffs states that “additional ad valorem duty on all imports from all trading partners shall start at 10 percent”.

Reality check meets Donald Trump

Simple as it is, the reasoning behind the Office’s calculation of reciprocal tariffs is economically unsound. Importantly, it is a common but flawed assumption that an increase in tariffs solely reduces imports. While tariffs will certainly raise the cost of foreign goods, thereby discouraging their consumption in the U.S., they will also trigger a range of broader economic adjustments.

First, U.S. producers of goods protected by tariffs – and there will be many – may respond by increasing prices due to reduced competition. Higher prices and limited substitutability can erode consumer purchasing power and limit overall consumption. With private consumption contributing most to U.S. economic growth in the last years, an economic slowdown with simultaneously increasing inflation would be at hand.

Second, U.S. firms producing for the domestic market, but sourcing their inputs from abroad will face higher input costs. Investment in domestic capacity to replace inputs from abroad would fall due to the uncertainty produced by the trade policy – against Trump’s narrative. Lower growth and employment would be a more likely outcome.

Third, in preparation for “Liberation Day”, U.S. trade partners have repeatedly claimed that they would not hesitate to retaliate with their own tariffs. This implies reduced U.S. exports and harm to domestic industries that rely on foreign markets. In the worst-case scenario, a fully-fledged trade war may spark a prolonged wave of global trade instability and push the world economy into recession.

It is, moreover, misguided to assume that tariff increases will only affect imports. In practice, trade is a two-way street. A country that exports less to the U.S. earns less foreign currency and may end up buying fewer U.S. goods in return. Past evidence clearly confirms the co-movement between exports and imports (Figure 4). This destroys the simple arithmetic of equation (3), exposing the shaky logic of Trumponomics.

Conclusion

No matter how elaborate or how simple the method for calculating “fair” tariffs may be, the idea that this alone will make America great again seems far-fetched. Still, a full-blown trade war is not inevitable. Governments that understand the mutual gains from trade may keep a cool head and continue pursuing free trade agreements, despite the current U.S. administration’s approach. There’s even a chance that the economic pain caused by erratic tariff policy will eventually prompt a U-turn in Washington. In the best-case scenario, governments everywhere recognize how much better off they are with free trade, and the world as a whole moves towards more open markets. After all, it costs nothing to hope. And it is certainly better than sleepwalking into a protectionist nightmare.

____________________________________________________________

1 From the “Liberation Day” speech by Donald Trump, available at https://www.youtube.com/watch?v=rcoAYkb6gYg.

2 The shock wave was immediately visible across financial markets. Following the announcement, U.S. Treasury yields slid, the U.S. Dollar depreciated against all major currencies and the S&P 500 finished the day 4.8% lower.

3 See the underlying explanation, available at: ustr.gov/issue-areas/reciprocal-tariff-calculations.

4 ibid.

LEGAL NOTICE

One of the purposes of this publication is to serve as advertising material.

The information contained and opinions expressed in this publication reflect the views of Flossbach von Storch at the time of publication and are subject to change without prior notice. Forward-looking statements reflect the judgement and future expectations of Flossbach von Storch. Actual performance and results may, however, differ materially from such expectations. All information has been compiled with care. However, no guarantee is given as to the accuracy and completeness of information and no liability is accepted. The value of any investment can fall as well as rise and you may not get back the amount you invested

This publication does not constitute an offer to sell, purchase or subscribe to securities or other assets. The information and estimates contained herein do not constitute investment, legal and/or tax advice or any other form of recommendation. In particular, this information is not a replacement for suitable investor and product-related advice and, if required, advice from legal and/or tax advisers.

This publication is subject to copyright, trademark and intellectual property rights. The reproduction, distribution, making available for retrieval, or making available online (transfer to other websites) of the publication in whole or in part, in modified or unmodified form is only permitted with the prior written consent of Flossbach von Storch.

Past performance is not a reliable indicator of future performance.

© 2025 Flossbach von Storch. Alle Rechte vorbehalten.