The automotive sector is currently making headlines for all the wrong reasons. Find out why BMW and Mercedes-Benz still rank among the top 10 in some of our fund portfolios.

There are few stocks that investors react to as emotionally as those of car manufacturers. Everyone knows their products, and many have strong opinions. However, there are a number of factors to bear in mind when investing in this sector.

With its globally renowned brands, technological revolutions, political influences and complex manufacturing processes, the industry faces a wide range of challenges. In a tweet in 2021, Elon Musk described the mass production of cars as a production hell: “Prototypes are easy, production is hard”; after all, Musk himself was on the brink of failure with Tesla at one point before the company finally turned a profit. And in this industry, economic dependence, high capital requirements and relatively low margins on average actually suggest that investors would be better off giving this sector a wide berth.

Why are we invested?

Of the more than 1,500 car companies founded in the USA since 1900, all but two – Ford and Tesla – have gone bankrupt or spun out of business at least once. More than 100 years later, the global market has consolidated into a handful of major manufacturers. Although the rise of electric mobility has brought a wave of new start-ups in recent years, many of these companies are already struggling to survive or are not making any money.

Around three-quarters of the global car market is in the hands of the 10 largest brands, including VW and Stellantis. As investors, we steer clear of these mass manufacturers and have opted for the premium segment. Our funds invest in shares of BMW and Mercedes-Benz Group.

We chose these particular brands because their products stand out from the crowd. They are not luxury goods, but they are high-quality and attractive products. While this does not necessarily lead to higher profit margins, it is nevertheless a good prerequisite for doing so. This is because the emotional appeal of brands promotes greater pricing power. Customers attribute a higher value proposition to them than to mass manufacturers.

Challenges and solutions

Of course, habits change. Mobility is defined differently today than it was 20 years ago, and young people emphasise that experiences are more important to them than material things. In metropolitan areas, ride-hailing services can also be a substitute for owning a car. However, there is still a desire for individual mobility in society. Not everyone wants to get from A to B in a delayed train or a plain taxi, no matter how inexpensive and efficient these modes of transport may be or could become. A BMW or a Mercedes-Benz, conversely, is perceived by many as what Starbucks calls a ‘Third Place’: a personal environment between home and work where people enjoy spending time.

In our view, both companies offer attractive products and other quality features that make them interesting to us and at the same time represent a protective barrier against new competitors. Both BMW and Mercedes-Benz have extensive experience in car manufacturing. This involves management and the implementation of industrial mass production. Mercedes-Benz, for example, has had a strong joint venture partner in China for 20 years in the form of BAIC. BMW is the largest car exporter in the USA. Both companies have always mastered global economic fluctuations, and the industry’s supply network, with millions of employees and international trade routes, is now precisely tailored to their needs.

They are familiar with political influence in every country in the world and have optimised security measures for goods procurement and warehousing over many years. Both companies operate with a high level of ‘local content’, meaning that they manufacture a large proportion of their sales in the respective sales countries. They offer product ranges tailored specifically to Chinese or American customers, such as long versions or XXL SUVs; this is added value that even Tesla, which is highly touted on the stock market, has yet to offer.

New competitors

Of course, things don’t always go according to plan. For example, the transition to electric mobility was initially too hesitant, and there was a struggle to meet Chinese customers’ demands for infotainment systems. As a result, there are currently many voices warning of attacks by Chinese competitors on the market territory of traditional German brands. But looking back, both companies emerged stronger from similar challenges. First, the Japanese pushed into the global market, followed by the Koreans. However, BMW and Mercedes have so far been able to maintain their position as premium suppliers, and we are confident that they will continue to do so in the current phase, which is characterised by great uncertainty.

There are several signs that this will be the case. For example, BMW has 30,000 employees in research and development (R&D) alone. Mercedes-Benz spends EUR 10 billion on this every year. It is currently the only car brand whose vehicles can drive across all five levels up to fully automated driving at level 3. Even Tesla and its Chinese competitors are not (yet) that far.

Thinking long-term

There are two ways of looking at the success of an investment. The first corresponds to the approach taken by the financial press, which has been particularly vocal in recent months. With headlines such as “Next car quake. BMW profits slump by 37 per cent”, or the headline that appeared shortly afterwards, “What the 20 billion loss means for shareholders”, it seemed as if one piece of bad news followed another. However, the media’s time horizons are usually short.

The second view is that of a long-term investor. For them, temporary fluctuations are less important. Investors are more interested in what an initial investment will be worth in 10 years or more.

We believe the second perspective is the correct one. But has it paid off for BMW and Mercedes-Benz so far? After all, there have been a wide variety of hurdles to overcome in the last five years alone, including a technological revolution in infotainment and assistance systems, the switch to electric mobility, which required high capital investments, and, most recently, a full-blown trade crisis. Zooming out a little on the timeline, the long-term performance of the two shares compared to the MSCI World Index can be seen in Figure 1.

The uncertainty associated with the trade crisis has indeed led to a decline in valuations in recent months. However, if you look at the longer-term performance of these stocks, you will see that there have been repeated share-price setbacks linked to uncertainty over the years, but these have always been followed by even greater share-price recoveries.

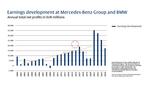

But to what extent are the share-price movements of automotive stocks underpinned by earnings trends? It’s true that Mercedes-Benz and BMW’s earnings are currently falling significantly compared with the previous year (see Figure 2). However, these declines in profits must be viewed in context, as must the share-price movements. We are coming from a comparatively high level of earnings after the Coronavirus pandemic, when many people began buying more durable consumer goods after the lockdowns began in 2020.

We therefore regard the bad news in the press as a return to normal for the long-term earnings trajectory of both companies. Of course, the question arises as to whether this time a structural break will occur, and BMW and Mercedes-Benz will lose their dominant position. These risks are one reason for the comparatively low valuations.

However, there are also opportunities. On the one hand, the companies have become more flexible in their production and innovation. They can adapt quickly to new competitors or production locations. On the other hand, BMW and Mercedes-Benz are operating from a position of strength. Despite high levels of investment, they have generated a combined free cash flow of more than EUR 77 billion over the past five years and have, despite dividend payments, net cash positions in the double-digit billion range. Thirdly, the past shows us that there have always been challenges and that the companies have overcome them every time.

In this respect, despite their relatively strong dependence on the economy, these companies can make a valuable contribution to the portfolio. The overall architecture of the portfolio is always decisive here. The aim must be to combine different business models, earnings profiles and cycles in order to increase resilience to various market scenarios. A balanced mix of different business models is therefore of central importance. There are solid reasons why BMW and Mercedes-Benz belong in our portfolio.

LEGAL NOTICE

One of the purposes of this publication is to serve as advertising material.

The information contained and opinions expressed in this publication reflect the views of Flossbach von Storch at the time of publication and are subject to change without prior notice. Forward-looking statements reflect the judgement and future expectations of Flossbach von Storch. Actual performance and results may, however, differ materially from such expectations. All information has been compiled with care. However, no guarantee is given as to the accuracy and completeness of information and no liability is accepted. The value of any investment can fall as well as rise and you may not get back the amount you invested

This publication does not constitute an offer to sell, purchase or subscribe to securities or other assets. The information and estimates contained herein do not constitute investment, legal and/or tax advice or any other form of recommendation. In particular, this information is not a replacement for suitable investor and product-related advice and, if required, advice from legal and/or tax advisers.

This publication is subject to copyright, trademark and intellectual property rights. The reproduction, distribution, making available for retrieval, or making available online (transfer to other websites) of the publication in whole or in part, in modified or unmodified form is only permitted with the prior written consent of Flossbach von Storch.

Past performance is not a reliable indicator of future performance.

© 2025 Flossbach von Storch. Alle Rechte vorbehalten.