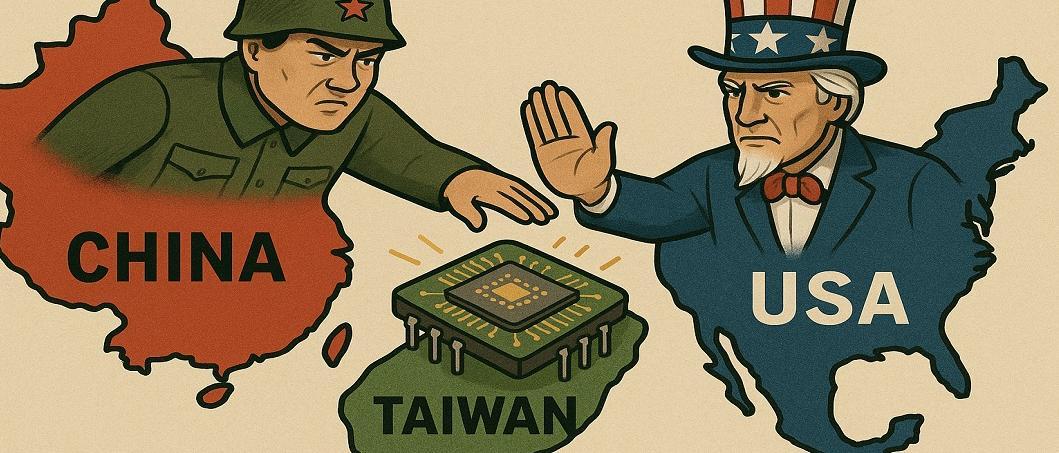

1. Will China invade Taiwan?

Taiwan is under threat. The island in the South China Sea is regarded by the People's Republic of China as a "renegade province" whose reunification is being sought. By force if necessary (Liu, Culver and Hart 2025). Further slowing growth could tempt China's President Xi to try to strengthen his power with land gains, even if this is costly and risky.

An "anaconda strategy" is intended to slowly choke off the small island state. The heavily armed two million men of the Chinese People's Liberation Army are only 130 kilometres away from the island at its narrowest point. Increased naval manoeuvres, now also east of Taiwan, and daily airspace violations are more than just intimidation.

War has already broken out in cyberspace. Targeted disinformation campaigns and diplomatic pressure on its allies are intended to isolate Taiwan. The fact that a major power like Russia can simply take land in the case of Ukraine has not made the situation any better for Taiwan.

2. The fragile reliability of the USA

However, Taiwan is allied with the USA, which is the world's largest military power. In the Taiwan Relation Act of 1979, the USA did not explicitly commit to defending Taiwan militarily in the event of an attack, as is the case with NATO.

“The United States will maintain the capacity to resist any resort to force or other forms of coercion that would jeopardize the security, or the social or economic system, of the people on Taiwan.” China has therefore had to assume that an attack on Taiwan could trigger a military conflict with the powerful USA.

In Donald Trump's erratic world of deals, however, the USA's promises have lost their value, as Canada and Mexico learnt in the case of NAFTA. The Europeans also no longer seem to be able to rely on the security commitments within NATO.

3. Cutting-edge technology as a protective shield

However, Taiwan has secured itself with the orientation of its economic structure. Semiconductors are the strategic raw material of the present and the future. As Chris Miller explains in his book "Chip War", computer chips are now more important for the war than tanks. Whoever leads in semiconductor technology not only controls cars, ships, aeroplanes and communications, but also weapons.

The Taiwan Semiconductor Manufacturing Company (TSMC) is the global leader in high-performance 5- and 3-nanometre chips, which - thanks to higher performance, lower energy consumption and smaller sizes - play a key role in artificial intelligence applications in particular. Its customers include Apple, AMD, Nividia and Qualcomm. 60% of all semiconductors come from Taiwan, while the USA imports 92% of its advanced logic chips from the small island.

Taiwan's former President Tsai Ing-wen has spoken of a "protective shield made of silicon". An attack by China on Taiwan could destroy the factories or even grant China access to the cutting-edge technology. Taiwan would only be able to withstand a total blockade for a few days. The threat to Taiwan from China is therefore not just a regional conflict, but a geopolitical and geo-economic threat that makes Taiwan's customers - whether they want it or not - into allies.

4. The dilemma for the USA

The US would like to free itself from its technological dependence on Taiwan by bringing the technology once developed in Silicon Valley back to the United States from East Asia. This would also extend the USA's technological leadership in artificial intelligence.

Under President Joe Biden, the "CHIPS and Science Act" (CHIPS stands for "Creating Helpful Incentives to Produce Semiconductors") mobilised 280 billion dollars for domestic semiconductor production in 2022. Of this amount, 53 billion dollars is accounted for by direct subsidies and 24 billion dollars by tax incentives for investments in semiconductor production.

In return for security policy commitments, Taiwan has agreed to the construction of TSMC plants in Arizona (and Dresden), which diversifies the geographical cluster risk in the production of high-performance chips. But because the new production capacities abroad are small and the production of high-end products remains in Taiwan, the monopoly remains on the island. How did this come about?

5. Military threat drives technological excellence

When the USA moved closer to Mao's China in 1972 and Taiwan had to leave the UN, Taiwan under Chang Kai-shek could no longer blindly rely on the USA. It therefore sought closer economic ties.

In 1985, there was a chance, as Stephan Thome describes in his book "Narrow Waters, Dangerous Currents". The development engineer Morris Chang had failed with his pioneering idea of independent semiconductor production at Texas Instruments. The Taiwanese Vice President Lee Teng-hui then generously offered him funding to set up his own plant in Taiwan, which became TSMC. Foreign capital investments and US-Americans on the board of directors secured the interests of the USA.

The military threat from China could therefore be a decisive reason why Taiwan has achieved market leadership in semiconductors, especially in the field of logic chips in the 3-nanometre range, through a unique ecosystem of research, development, innovation, production, motivation and quality control, and has secured it to this day.

6. Threat as a discovery procedure

According to Friedrich August von Hayek, competition drives companies to innovate because this can increase profits (competition as a discovery procedure). However, as soon as an innovation is successful, it is copied, which makes new innovations necessary. A high degree of competition drives technological progress.

In the case of Taiwan, Hayek's concept can be expanded to the effect that it is not only global competition in chip production with South Korea, Japan, China and the USA that has driven Taiwan to peak performance. But also the fear of China and the associated struggle for the urgently needed military protection of the USA.

The state can act as a catalyst - as with the Apollo programme in the USA, which was triggered by the Sputnik shock of the Soviets. However, according to Hayek, this will not work in the long term without free private initiative and the cooperation of employees in companies.

7. Economic policy implications

Creativity is an inexhaustible and free resource that cannot be mobilised on demand or even by government coercion. The fear of China is probably a key reason for the high performance of TMSC's workforce, which cannot be replicated in other countries.

It is right to mitigate the greatest dependencies and to reorganise (derisking) or diversify (friendshoring) global value chains from a security perspective. However, attempts to relocate the production of high-performance chips to other countries as part of large-scale industrial policies will be doomed to failure in the case of Taiwan. This is because the political and economic climate there cannot be reproduced elsewhere.

This would also be undesirable from a geopolitical perspective, as relocating the production of high-performance chips out of Taiwan would increase the likelihood of an invasion or total blockade of Taiwan by China. The geopolitical situation would only be further destabilised unnecessarily.

_________________________________________________________________

Literature

Hayek, Friedrich August 1969: Competition as a discovery process. Competition as a discovery process. In: Hayek, F. A. v. (ed.) Freiburger Studien. Tübingen, 249-265.

Liu, Bonny / Culver, John / Hart, Brian 2025: The Risk of War in the Taiwan Strait Is High - and Getting Higher. Foreign Affairs 15 May 2025.

Miller, Chris 2022: Chip War: The Fight for the World's Most Critical Technology. Sribner, New York.

Thome, Stephan 2024: Narrow waters, dangerous currents. Suhrkamp, Berlin.

LEGAL NOTICE

One of the purposes of this publication is to serve as advertising material.

The information contained and opinions expressed in this publication reflect the views of Flossbach von Storch at the time of publication and are subject to change without prior notice. Forward-looking statements reflect the judgement and future expectations of Flossbach von Storch. Actual performance and results may, however, differ materially from such expectations. All information has been compiled with care. However, no guarantee is given as to the accuracy and completeness of information and no liability is accepted. The value of any investment can fall as well as rise and you may not get back the amount you invested

This publication does not constitute an offer to sell, purchase or subscribe to securities or other assets. The information and estimates contained herein do not constitute investment, legal and/or tax advice or any other form of recommendation. In particular, this information is not a replacement for suitable investor and product-related advice and, if required, advice from legal and/or tax advisers.

This publication is subject to copyright, trademark and intellectual property rights. The reproduction, distribution, making available for retrieval, or making available online (transfer to other websites) of the publication in whole or in part, in modified or unmodified form is only permitted with the prior written consent of Flossbach von Storch.

Past performance is not a reliable indicator of future performance.

© 2025 Flossbach von Storch. Alle Rechte vorbehalten.