Investment funds at a glance

A large portion of the assets entrusted to us is allocated to our mutual funds, in particular Flossbach von Storch - Multiple Opportunities. More than one million investors across Europe have invested in this strategy. They include the founders, their families, the company’s employees, friends and acquaintances. They all share the same interest: preserving their assets and generating attractive long-term returns.

Investment funds at Flossbach von Storch

A fund is made up of different securities. In an actively managed fund, analysts and fund managers carefully select the securities included. They diversify the portfolio, thereby reducing risk – and, of course, taking advantage of opportunities that arise. Equity or bond funds contain only securities from one asset class, namely equities or bonds. Our multi-asset funds contain equities, bonds and gold in varying proportions.

Multi-asset funds

Our actively managed multi-asset funds contain carefully selected equities, as well as bonds and gold. This allows investors to invest in multiple asset classes with just a single product. Due to broad diversification and active management by experts, multi-asset funds offer comprehensive asset management.

Equity funds

We also pursue an active global investment approach with our equity funds. We set high qualitystandards for the companies in which we invest – in terms of their business model, balance sheet and management. Our in-house investment team is in constant contact with ‘our’ companies. We view the purchase of a share as a long-term investment.

Bond funds

Our bond funds are suitable for investors who want to reduce volatility or diversify their assets. Naturally, our fund managers also pursue an active investment approach with our bond funds and utilise opportunities with a wide variety of bond types. Securities are selected as part of a fundamental analysis process.

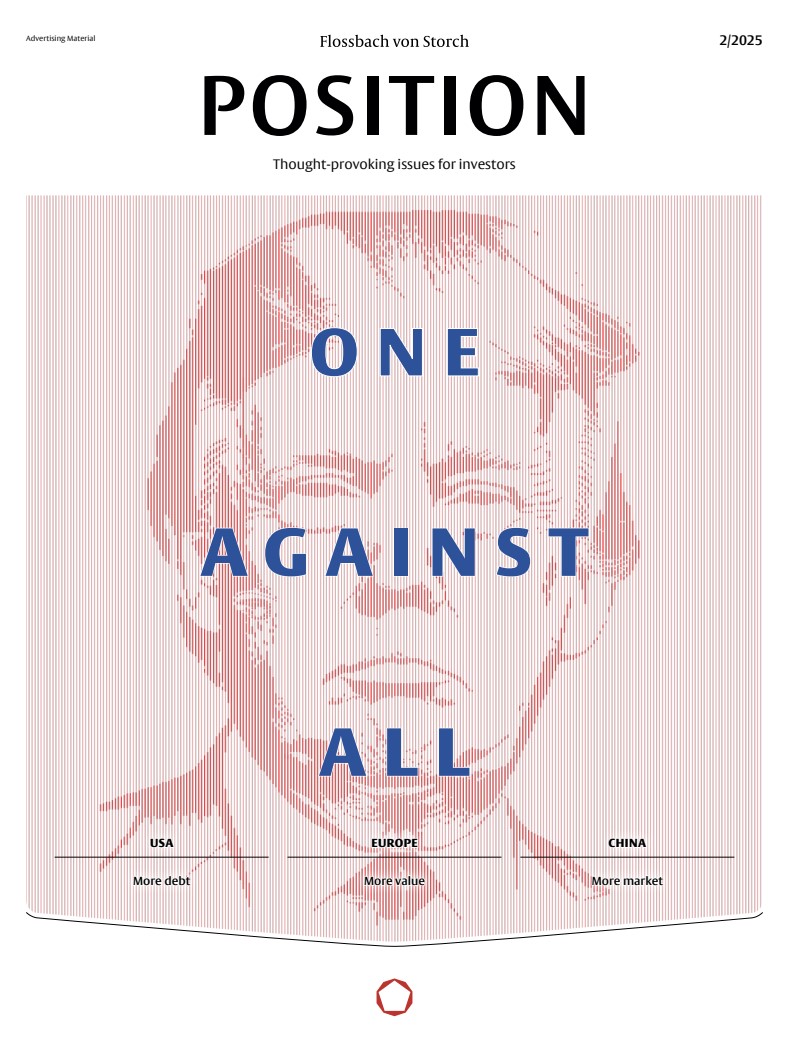

Position

The Flossbach von Storch magazine

“Position” is published regularly and explains how the financial markets work – and how to invest your assets robustly. In addition to practical information on the subject of money, you will find analyses on monetary policy, investment strategy and developments in the financial markets. Our aim is to provide you with topics and thought-provoking issues that will help your professional and personal development.