Transparent costs

With us, transparency does not end with a look at your portfolio - we also focus on transparency when it comes to costs: our all-in fee covers all services. There are no additional costs. Determining your personal investment strategy is non-binding. All you need is your e-mail address.

Our all-in fee

From an initial investment sum of 100,000 euros

1.20 percent per year

From an initial investment sum of 1,000,000 euros

0.95 percent per year

Included in the all-in fee:

- Custody account fees

- Strategy change

- Portfolio monitoring

- Free deposits and withdrawals

- Personal customer support

Total flexibility:

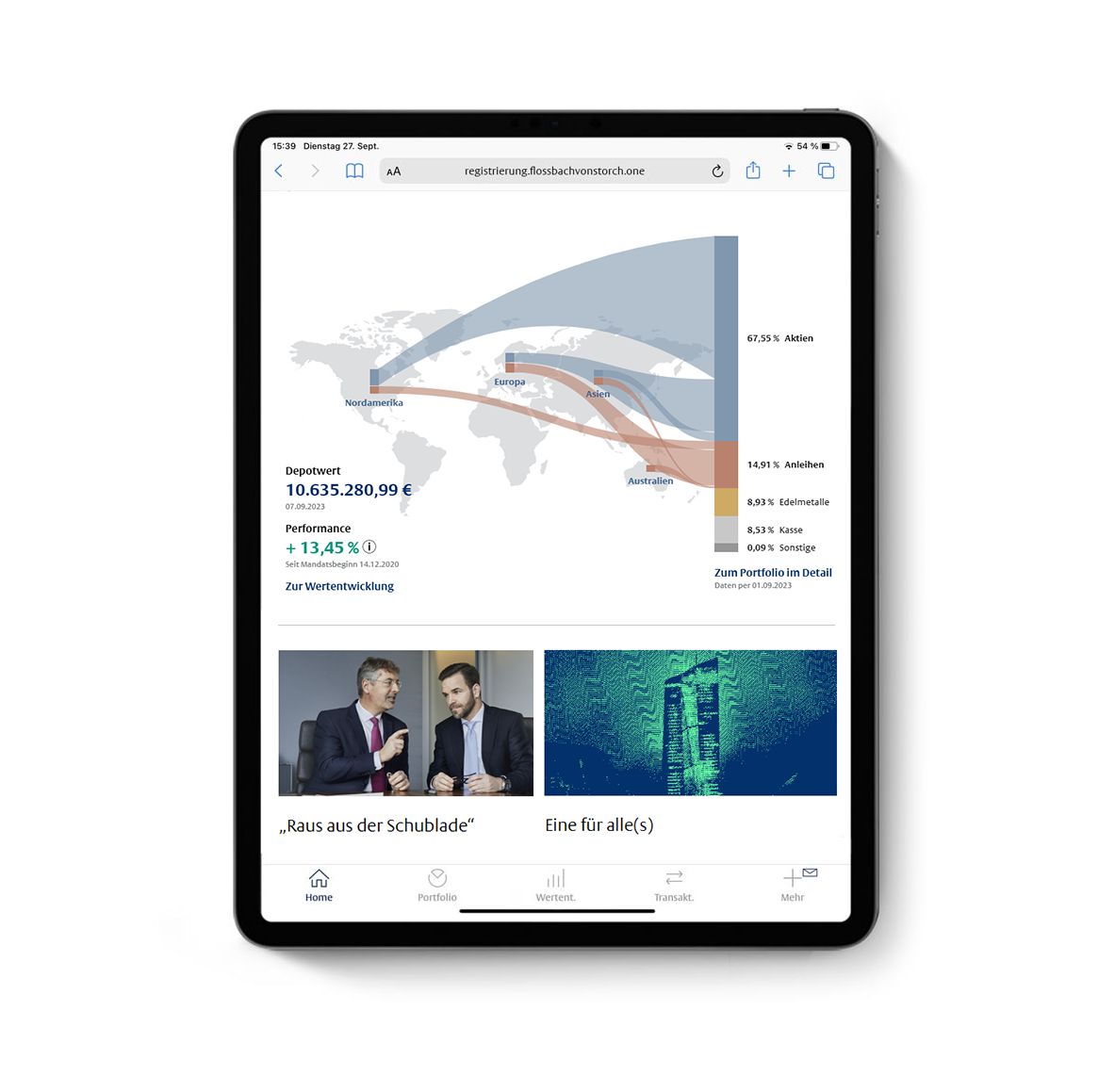

- Portfolio access via digital client portal

- No minimum investment period

- Flexible savings and withdrawal plans

- No notice periods

- Client support available with or without an appointment

Further information

The three sub-funds are distributing funds; however, distributed income is automatically reinvested.

If the minimum investment amount is invested, a regular investment plan of at least EUR 100 can also be set up.

The investment plan can be deposited monthly, quarterly, semi-annually or annually, as desired.

We do not make any promises about returns, that would simply be dubious. Our aim is to achieve attractive long-term returns, depending on the respective investment strategy.

As a general rule, the higher the proportion of equities in the investment strategy, the higher the expected return - but the higher the risk of loss.

There is no minimum term. You can of course access your assets at any time. Nevertheless, we recommend a minimum investment term of at least three years so that your investment strategy, which is designed for the long term, can unfold.

The minimum investment amount for private individuals is 100,000 euros. Companies can invest in a Flossbach von Storch ONE strategy from an investment amount of 250,000 euros.